The Glory Days

When I turned 4 I was given a $1 allowance every Friday. This would be the happiest day of the week for me. We would go to the store on Saturday so I would spend Friday night sleepless in bed trying to determine the most candy I could get for my money. Funny enough, that was the most important thing in my life at 4. I knew the butterfinger, and jolly rancher usually went on sale for 4 for a dollar. Note: Butterfingers are my favorite. The snickers would be 35 cents and the skittle would be 50. I would eat them all during the weekend (I definitely would have failed the marshmallow test).

As I got older the effect of the money started to wear off. When I went to high school, I got $4 dollars a week. This money seemed to be a drop in the bucket. I was making $7 an hour as a bag boy at the local grocery store and I was living large. I would go to the movies, buy pogs and bought my cell phone. It was a classic Nokia brick.

The College Years

Then I went to college and was broke. I would debate over whether I needed mayo on sandwiches, if I could live with the .99 cent bread, I only got the cheapest shampoo, and dollar store deodorant was what I used. I think I smelled good.

Today

That brings us close enough to today. I feel like a frugal person in general, but when I think hard about my purchases I know that some things are name brand, I buy the bread that I think tastes the best, and I buy all the mayo I’d ever want. I find all types of ways to mentally rationalize some purchases, but what I worry most about are the purchases I don’t even think about any more.

The Judge

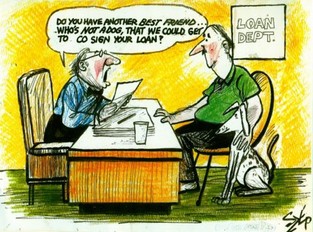

I point out people’s financial short coming all the time. I have a brother-in-law that just bought a house a few months after they became a two income home, and he talks about the endless projects he’s going to work/spend money on. I see people buying new cars when they probably could have gotten a few more years out of their old one. I see people buying name brand cereal at full price. Some days I want to do a Diembe Mutombo on these people. Then I take a step back and realize I’m not perfect.

When I make these occasional observations that I need to be examining my spending. I get the generic brand corn flakes, I get the dollar shampoo, I make meals out of canned foods that made their way to the back of the cabinets. I try to squeeze save every cent possible. This normally only last a week or so and then things gradually go back to normal. Sometimes a couple of the new habits will stick and I try to have a sense of pride about some unusually cheap things that we do. Since I’ve been reading and writing more about personal finance lately, I have also gotten some really interesting and painless tips from various authors. In the back of my mind I do wonder what I have stopped worrying about. Maybe I’m buying a few too many butterfingers.

| Do you feel like you have stopped thinking about some of your purchases? What do you do to bring them back into your consciousness? |

RSS Feed

RSS Feed